by

by

When talking to executives, technologists and marketing people I'm surprised when they over-simplify how the global economy functions, and is changing. Here are some key understandings and implications I use when analyzing events.

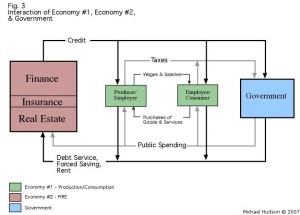

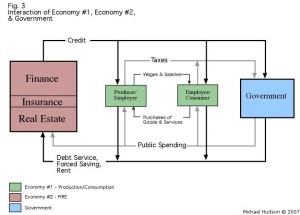

My framework for recognizing the forces impacting businesses is to isolate three economies and define them as below.

1) Global Economy - how countries settle trade balances (international clearing)

2) Financial Economy - disk drives and filing cabinets with "claims" on the real economy

3) Real Economy - making, buying and selling stuff

Taking them one-at-a-time with key takeaways...

GLOBAL ECONOMY - 4 important things to know about the Global Economy...

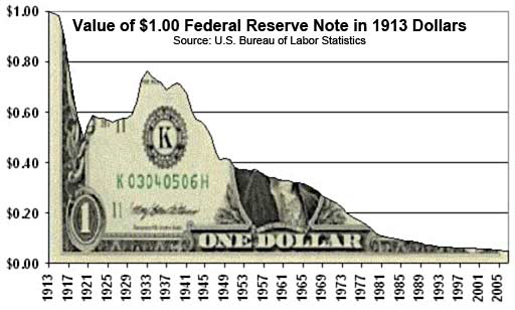

1) Prior to 1971 there was an agreed-upon system (1944 Bretton Woods fixed-exchange rates) but in 1971 things went rogue (US dropped peg to Gold and currencies "float") and many policies have STILL not adapted to the new structure.

Takeaway: I thought Foreign cars held their value better than US cars but it was the US dollar, not the cars, that was changing. Even Congressmen don't get how rapidly rates change (up to 20%/year, and 100% over 5 years for the Yen) and how Global Capital Flows affect everything.

2) Floating exchange rates were intended to be market set, but countries game the system by manipulating (pegging), here's 34 doing it http://goo.gl/43B9ic

Takeaway: Countries create mercantile policies that "advantage" them in global markets for DECADES. But markets will EVENTUALLY clear. (China and Germany)

3) The US is the "reserve currency" so transactions occur (not just price) in dollars. Therefore the US must create enough "working capital" dollars for both the US and the rest of the world's International Trade (~50% of US Dollars are in the USA and ~50% overseas with the US share of global GDP at ~20% now, ~31% in 1971 and ~40% in 1941)

Takeaway: Policymakers make mistakes since changes in foreign demand for US$ can be as large as monetary policy impacts on the supply. QE and other policies can cause foreign bubbles but subdued US impact with all the moving parts.

4) In 1969 a new global "unit of account" called "Special Drawing Rights" http://goo.gl/5kQGnp. SDR's were set up to be a "worldwide reserve currency" . In fact, the US Post Office accepts SDR's as payment! http://goo.gl/C0jlrG

Takeaway: The global monetary system is being restructured. Expect unintended consequences and economic hiccups.

FINANCIAL ECONOMY - 3 important things to know about the Financial Economy...

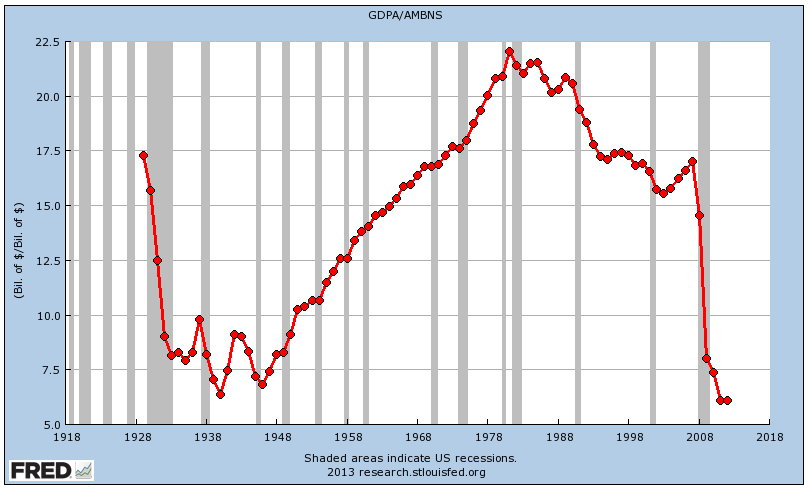

1) 10x bigger than the Real Economy (Bain & Co. estimates globally ~$600T financial assets supported by ~$63T GDP http://goo.gl/NQWYFX )

Takeaway: The Financial Economy can jerk the real economy around with bubbles and busts even when the real economy looks good. E.g. 2000 tech, 2008 mortgage, 2015 shale oil etc.

2) Since the early 1900's manipulating the financial economy (e.g. capital gains vs. income tax rates, IRA's, Mortgage Interest deduction etc.) has become the PRIMARY tool of Politics.

Takeaway: Policy changes provide huge business shifts. E.g. Tax credits built Hollywood, Obamacare and the Insurance Companies, tax credits and Solar etc.

3) Since 1971, the Federal Government (NOT State or Local) can Print as much money as they want (they don't need to borrow). Ben Bernanke (Chairman of the Federal Reserve) said during a Congressional Testimony "... with all do respect Senator, the US will always pay it's bills unless you direct the Fed to not make the computer entry" http://goo.gl/r32iEl. They are limited by inflation which is a function of (global) demand for US$.

"Private sector SAVINGS is equal to the Federal DEFICIT to the penny!" -Warren Mosler

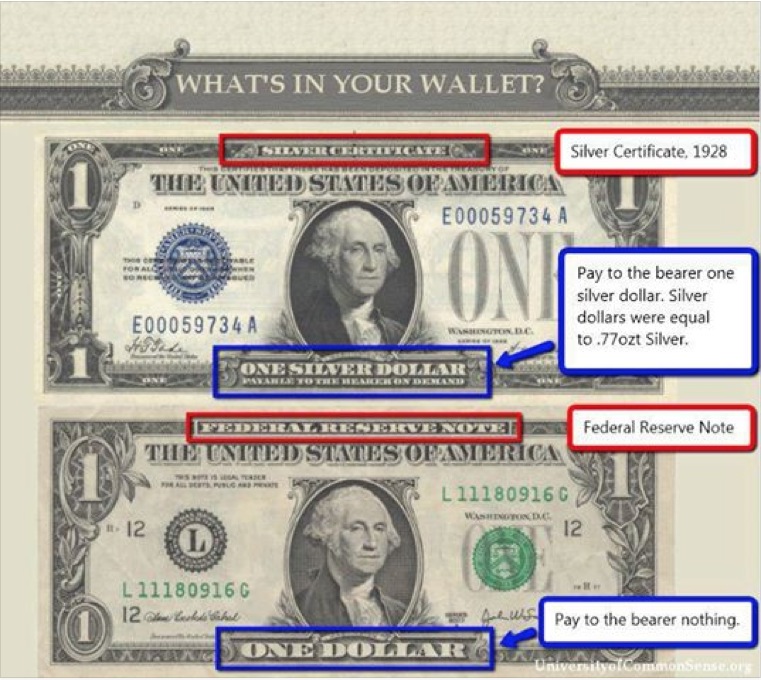

The cash (ASSET) in your pocket shows up as a LIABILITY on the Federal Reserve's Balance Sheet! Money is scorekeeping, home economics doesn't apply to the Federal Government they MIRROR the private economy.

Takeaway: We've had ~12 balanced budgets since 1940, there is no intention of ever repaying the federal debt (nor is it necessary) http://goo.gl/ExHANm. Federal interest expands the money supply, but allows financial intermediaries to allocate the expansion, growing the Financial Sector. Shrinking deficits slows GDP if money velocity remains constant.

REAL ECONOMY - 3 important things to know about the Real Economy...

1) It is jerked around by the Financial Economy expanding and shrinking credit

Takeaway: See Financial Economy 1-4

2) It is jerked around by the Global Economy moving money into and out of the US. (Globalized Finance)

Takeaway: See Global Economy 1-4

3) Export / Import financial data collection was built during fixed exchange rates, based on currency not units. Accuracy is a function of exchange rate volatility in any given period.

Takeaway: Export/Import to a country expressed in currencies (vs. Units) cannot be compared over time. Unit trade numbers can be off by 20% with the same $ trade number in a single year!

FINALLY

Ray Dalio of Bridgewater Investments created a wonderful video called "How the Economic Machine Works" https://www.youtube.com/watch?v=PHe0bXAIuk0 Ray clarifies how buying things with money vs. buying things with credit and productivity in the real economy interact. It's 30 minutes, watch it.

Here's a paper on the same http://goo.gl/s2Nanq

I hope this helps...

by

by