You don't need to understand an internal combustion engine to drive a car, and you don't need to understand a monetary system to participate in an economy.... BUT TO FIX AN ENGINE OR ECONOMY YOU DO.

I cringe when I see the majority of people believing what I did for most of my life, that our government borrowed to get money to spend (like we do). THEY DON'T. I've written a little bit about this in How to Think About Economics.

Rebooting the U.S. Economy in a Thought Experiment

Pretend there is no money and we have to reboot the economy, lets think through this...

- The US gov't has a monopoly on creating money (a "fiat" monetary system)

- They "spend" the money into circulation (buy stuff from us) or "give" the money to us (social benefits)

- If they tax the same amount back (balance their budget) WE HAVE NONE LEFT

- Therefore: The U.S. government Deficit MUST EQUAL our savings to the penny!

State and Local government economics are the same as you and I, they must "earn" (tax) their money since they cannot create it like the feds.

So applying the same economic rules and thinking for your household, business or state government DOESN'T APPLY TO THE FEDERAL GOVERNMENT when you understand the mechanics of "Money Issuers" vs. "Money Users".

Warren Mosler is a guru of "Modern Monetary Theory", and wrote a short book called "The Seven Deadly Innocent Frauds of Economic Policy"

This book, shows why, in the fiat U.S. monetary system, the following are FALSE understandings:

- The government must raise funds through taxation or

borrowing in order to spend. In other words, government

spending is limited by its ability to tax or borrow. - With government deficits, we are leaving our debt burden

to our children. - Government budget deficits take away savings.

- Social Security is broken.

- The trade deficit is an unsustainable imbalance that takes

away jobs and output. - We need savings to provide the funds for investment.

- It’s a bad thing that higher deficits today mean higher

taxes tomorrow.

WOW... are you saying the federal deficit is a measure of how much money WE (the non-federal government entities--including their employees) have? YES THAT IS WHAT I'M SAYING. This is true for all fiat monetary systems which the U.S. has had since ~1933. Remember the trillion dollar coin? YES they can mint a $T coin but....this is all about DISCIPLINING government spending, there are no operational reasons.

In How to Think About Economics one of my takeaways is:

Ben Bernanke (Chairman of the Federal Reserve) said during a Congressional Testimony "... with all due respect Senator, the US will always pay it's bills unless you direct the Fed to not make the computer entry"

Why did we do it this way and what the hell is money anyway?

Reading about the history of money is 1/2 human psychology and 1/2 the rise and fall of governments and the interaction of politics, money and banking. I've read many books but recommend "Money, the unauthorized biography" by Felix Martin. From the Silicon Valley's of the ancient world, to Russia's attempt to abolish money and banking, to today's Vampire Squid (Goldman Sachs) and cryptocurrencies, Felix tries to convince you how inherently political money is. (This is a blind spot of bitcoin geeks who miss the transitive property: money=power and politics=power therefore money=politics).

"There was in the village near by a family whose wealth was unquestioned---acknowledged by everyone--- and yet no one not even the family itself had ever laid eye or hand on this wealth...known only by tradition...the past two or three generations...lying at the bottom of the sea"

--- From "Money" by Felix Martin

Over the last few hundred years economists have generally agreed that money has 3 functions:

- A unit of account (measure things in the unit of "dollars, yen or euros")

- A medium of exchange (equate to "dollars" and use them instead of barter)

- A store of value (store up my labor etc. in dollars or shekels to spend later)

This is a useful framework because it gives you 3 axis to think about how politics and money interact. Examples include:

Example 1: Monkey with the unit of account

The Consumer Price Index is used to index wages and Social Security benefits, hence by growing it slowly, the government "saves" money, this is why the measurement keeps changing. shadowstats.com computes the CPI using the same algorithm as 1990 to show how it's been lowered. A POLITICAL MOTIVE?

Example 2: Monkey with the medium of exchange

The cashless society is being pushed as a solution to big crime (money laundering). But physical money has a property no other representation has, ANONYMITY FOR ALL CITIZENS. All electronic transactions enable, the federal government(s) to track global transactions and enforce new international tax regimes such as described here and here. A POLITICAL MOTIVE?

The cashless society is being pushed as a solution to big crime (money laundering). But physical money has a property no other representation has, ANONYMITY FOR ALL CITIZENS. All electronic transactions enable, the federal government(s) to track global transactions and enforce new international tax regimes such as described here and here. A POLITICAL MOTIVE?

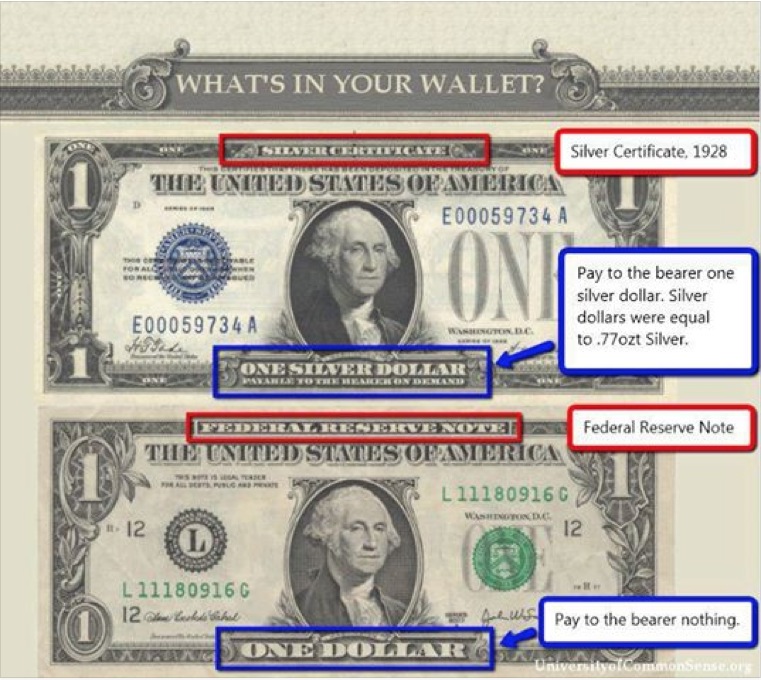

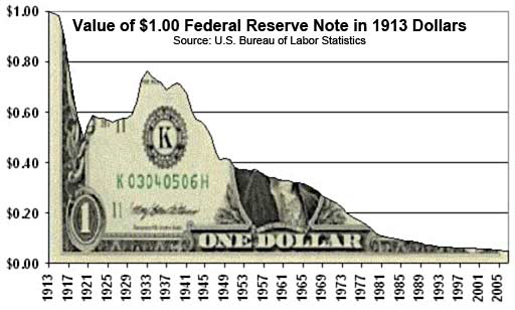

Example 3: Monkey with the Store of Value

The government gets to spend money first, they usually issue debt to economically "sterilize" their expenditure. If the central bank purchases the debt by printing money, it's "monetized" (didn't pull the same amount of money out of circulation). If a "primary dealer" bank buys the debt the bank gets the first spend of all interest payments. If the supply of money and credit grows faster then productivity and population (inflation targets), then the value of the currency declines and the first to spend it receives a purchasing power advantage. Rome did this by shaving the amount of gold or silver from the coins. Avoiding deflation or A POLITICAL MOTIVE?

The government gets to spend money first, they usually issue debt to economically "sterilize" their expenditure. If the central bank purchases the debt by printing money, it's "monetized" (didn't pull the same amount of money out of circulation). If a "primary dealer" bank buys the debt the bank gets the first spend of all interest payments. If the supply of money and credit grows faster then productivity and population (inflation targets), then the value of the currency declines and the first to spend it receives a purchasing power advantage. Rome did this by shaving the amount of gold or silver from the coins. Avoiding deflation or A POLITICAL MOTIVE?

TAKEAWAYS

Modern Monetary Theory Teaches us:

- Federal Spending is limited by inflation. Government debt serves as: a) a check and balance on spending, and b) a risk free asset in the private economy, it is not operationally necessary.

SPENDING MORE (Democrats) or TAXING LESS (Republicans) is the SAME ECONOMICALLY

- Federal governments issue money, everyone else (including state and local government) use it. Hence state and local deficits are a debt burden on our children, federal is not.

BE MORE OF A TIGHTWAD on STATE AND LOCAL SPENDING

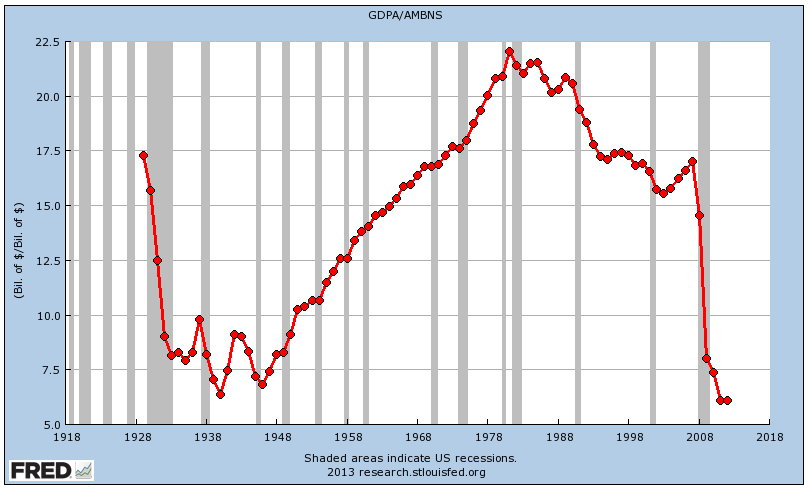

- Deflationary forces (aging demographics + globalized labor + technology+high debt), moves money from spending to savings.

SHRINKING DEFICITS CAUSE RECESSIONS WITHOUT CREDIT OR VELOCITY GROWTH

- When the deficit is growing (and money velocity is not slowing down), then money should increase GDP as it enters the economy.

DEFICITS CAUSE THE STOCK MARKET TO RISE (MONEY STORED IN THE PRIVATE SECTOR)

Money Velocity (GDP/Money Supply) Measures how many times a dollar gets spent in a year. Note the drop in velocity during recessions, especially 2008-Now.

- Money is Politics

BUDGET CEILINGS, CASHLESS SOCIETIES USUALLY HAVE ULTERIOR POLITICAL MOTIVES

If you haven't watched this.... watch it... How the Economic Machine Works.

-jeff

Hmm it looks like your site ate my first comment (it was super long)

so I guess I'll just sum it up what I wrote and say, I'm thoroughly enjoying your blog.

I as well am an aspiring blog writer but I'm still

new to the whole thing. Do you have any points for newbie blog writers?

I'd genuinely appreciate it.

Very interesting Jeff! Cannonball

First of all I want to say excellent blog! I had a quick question which I'd like to ask if you do not mind.

I was curious to know how you center yourself and clear your thoughts before writing.

I've had difficulty clearing my thoughts in getting my thoughts out there.

I do take pleasure in writing however it just seems like the first 10 to

15 minutes tend to be wasted simply just trying to figure out how to begin. Any ideas or tips?

Thanks!

This article gives clear idea designed for the new people of

blogging, that actually how to do running a blog.