Watching a presentation on scaling microservices by Adrian Cockcroft http://perfcap.blogspot.com/ Adrian mentioned Twitter had over 1M developers using their API's. DEVELOPERS, not API calls or Apps using the API's etc. WOW!

Watching a presentation on scaling microservices by Adrian Cockcroft http://perfcap.blogspot.com/ Adrian mentioned Twitter had over 1M developers using their API's. DEVELOPERS, not API calls or Apps using the API's etc. WOW!

So when Fred Brooks published "The Mythical Man-Month" in 1975 (MUST reading for all managers esp tech) he described solving the people scaling problem at IBM using clever team designs. His "Perfectly Partition-able Task" (like picking corn or strawberries) stuck in my head (I read it in the early 80's) as a framework ever since.

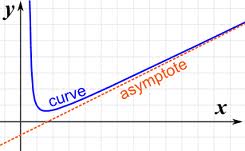

The gist was that teams working on complex systems had a communications/coming up to speed burden proportional to (N^2-N)/2 , where N is the number of team members (developers). So if we can scale "Dev Ops" unbounded using these architectures, I believe we have a tangibly different world than the words "big data", "cloud computing" or scalable software captures.

Partitioning tasks changed the size of things we built in the physical world... pyramids, Ford's assembly line, etc. it will do the same for what we build in the information world. A much bigger deal than many recognize...